Insurance & Re-Insurance

Leading insurers are relying on incremental digital innovation to deliver value…

But there’s a major discrepancy.

Insurers are looking to increase customer interactions and become trusted risk advisors, but are held back by legacy system constraints and operational expenses. Traditional business models are no longer cutting it.

However, new technologies, changing demographics and channels, and increasing consumer expectations are creating disruption opportunities to be seized by insurers.

Insurance & Re-Insurance

Leading insurers are relying on incremental digital innovation to deliver value…

But there’s a major discrepancy.

Insurers are looking to increase customer interactions and become trusted risk advisors, but are held back by legacy system constraints and operational expenses. Traditional business models are no longer cutting it.

However, new technologies, changing demographics and channels, and increasing consumer expectations are creating disruption opportunities to be seized by insurers.

At Aureus, we know that the key to good financial health of an insurance company, is a Healthy Combined Ratio.

At Aureus, we know that the key to good financial health of an insurance company, is a Healthy Combined Ratio.

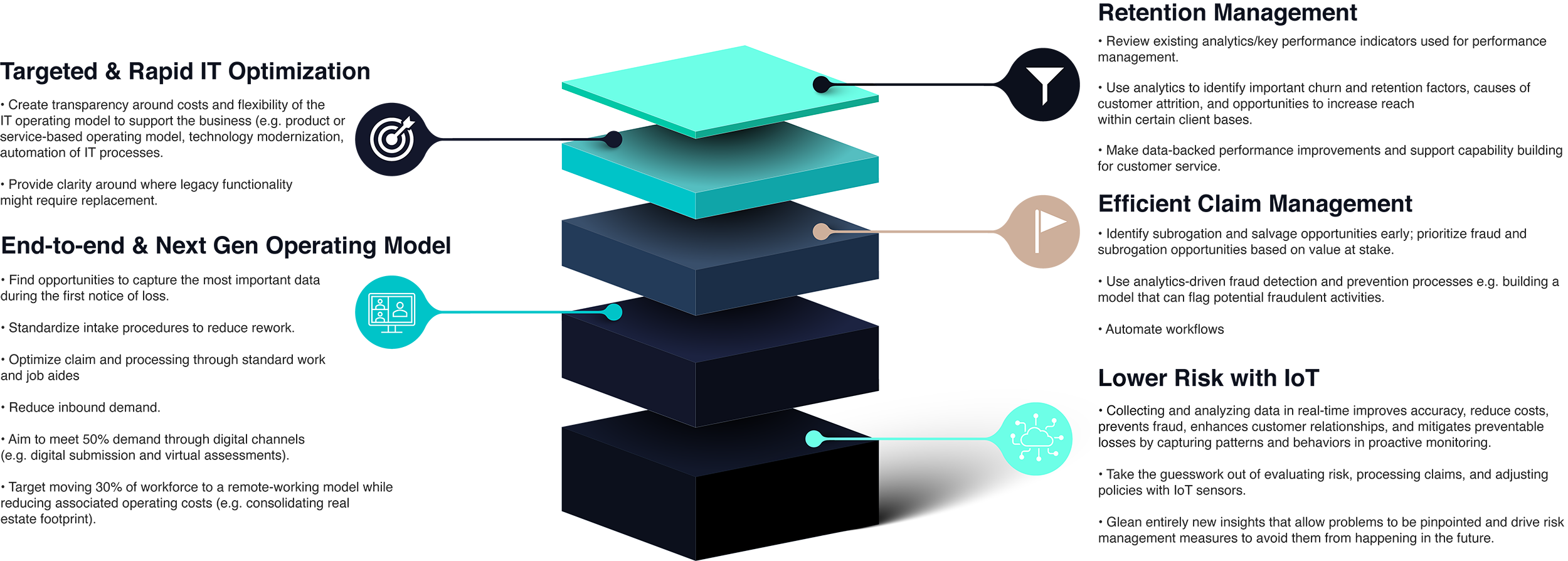

Building Blocks to Improve Combined Ratio

Building Blocks to Improve Combined Ratio

Using AI, Big Data, Scalable Azure Cloud, and IoT, Aureus offers innovative, agile solutions that transform a legacy landscape and applications into the serverless cloud while ensuring data is all in one location.

Enter new markets fast

Consolidated view of their customers and insurance policies at the same time to effectively communicate with customers throughout their lifecycle, not just in that one sales process

Decreases, manages, and assesses risk better

Connects departments and breakdown silos

Improve customer experience and communication

Streamlines workflows, process reports, and conducts SOPs with unparalleled speed so employees can focus on important business items

Improves decision-making during triage (increase hit rate in sales)

Envision new digitally-focused business models

Land more deals

Using AI, Big Data, Scalable Azure Cloud, and IoT, Aureus offers innovative, agile solutions that transform a legacy landscape and applications into the serverless cloud while ensuring data is all in one location.

Enter new markets fast

Consolidated view of their customers and insurance policies at the same time to effectively communicate with customers throughout their lifecycle, not just in that one sales process

Decreases, manages, and assesses risk better

Connects departments and breakdown silos

Improve customer experience and communication

Streamlines workflows, process reports, and conducts SOPs with unparalleled speed so employees can focus on important business items

Improves decision-making during triage (increase hit rate in sales)

Envision new digitally-focused business models

Land more deals

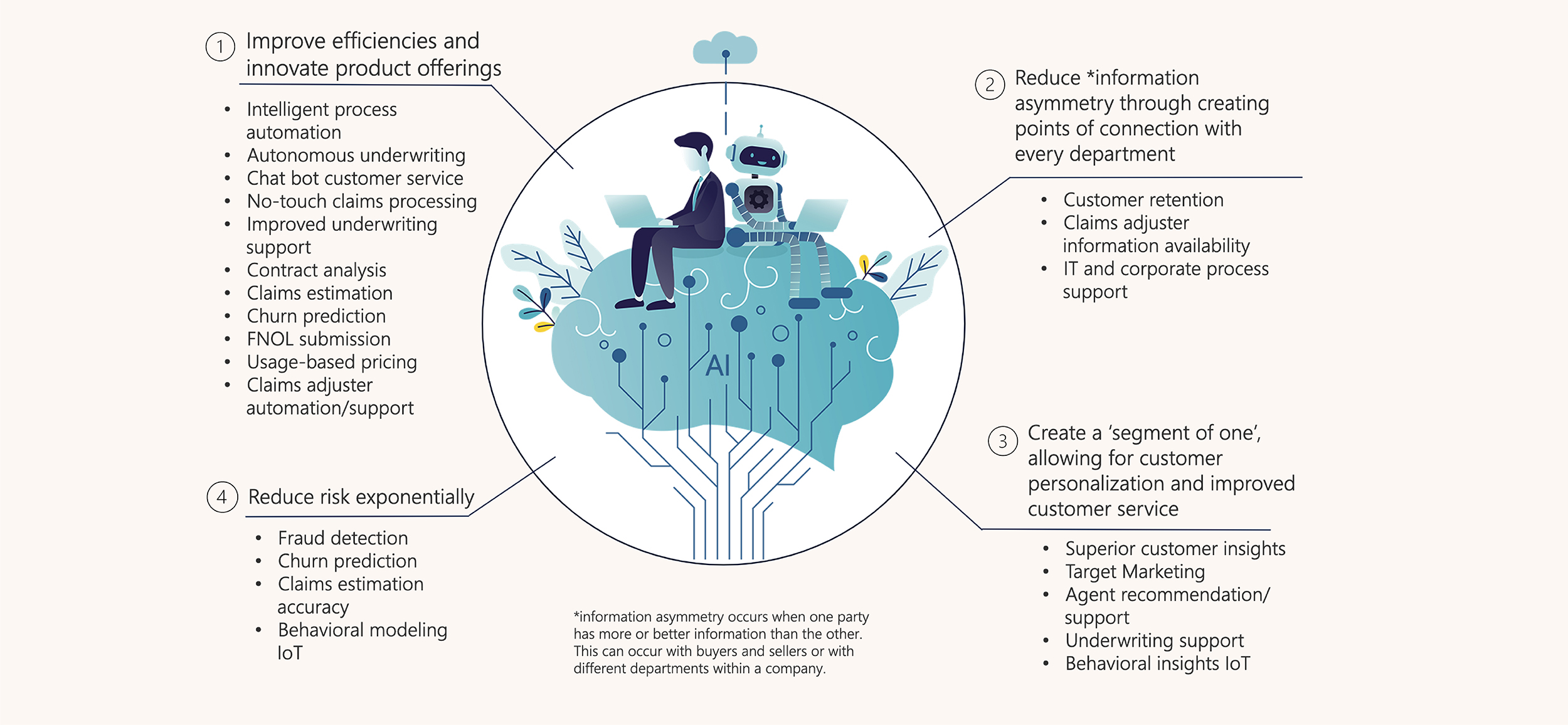

How Aureus AI Solutions Can Help Your Insurance Company

How Aureus AI Solutions Can Help Your Insurance Company

All of Aureus’s AI-based capabilities work together as a comprehensive solution—built on data—to help insurance companies become a knowledge-based company.

All of Aureus’s AI-based capabilities work together as a comprehensive solution—built on data—to help insurance companies become a knowledge-based company.

Forbes Law Worker’s Compensation Insurance Case Study Outcome

Forbes Law Worker’s Compensation Insurance Case Study Outcome

A One-Stop-Shop 360° Aureus Customer Engagement Management (CEM) Insurance Solution

Insurance companies are rich in data, and that data is exponentially growing. The answer to handling and harnessing the potential of this data, is transforming a traditional CRM solution into a Next Gen, Data-driven, Cloud-native Customer Engagement Management (CEM) platform. Aureus’s 360° CEM Connect Solution empowers staff with a 360° view of the customer, enabling superior customer and broker experience. 360° CEM Connect:

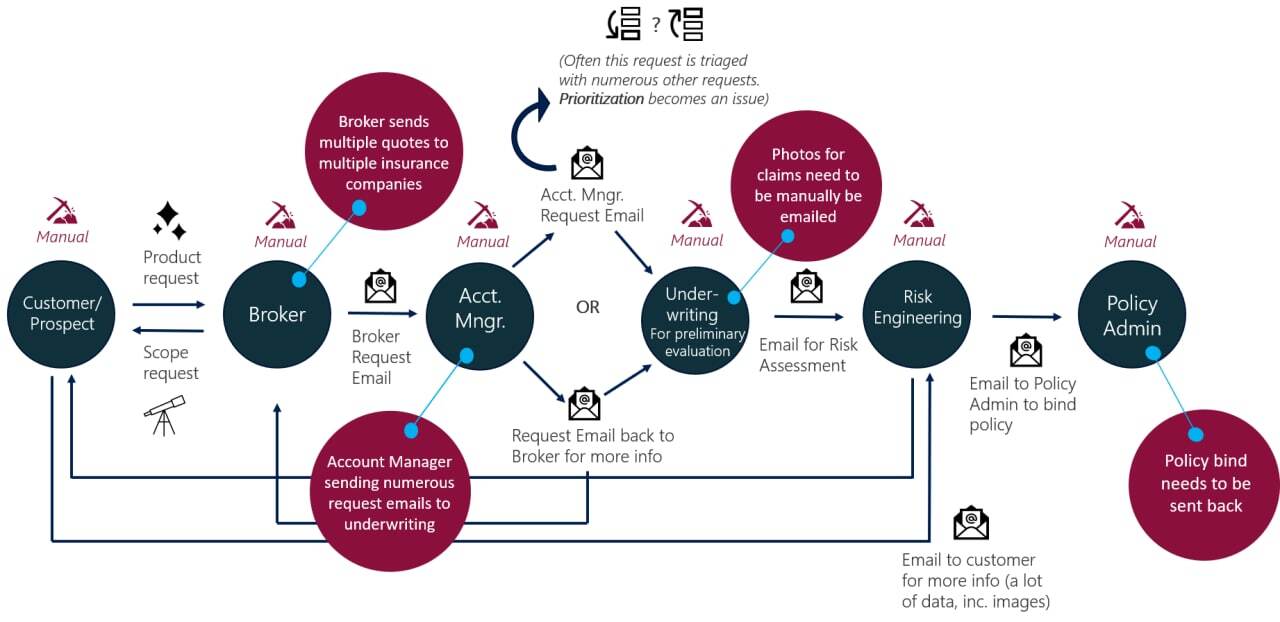

Current Non-Streamlined Claim Workflow

Example: First Notice of Loss Flow

(Back and forth paper-pushing)

Current Non-Streamlined Claim Workflow

Example: First Notice of Loss Flow

(Back and forth paper-pushing)

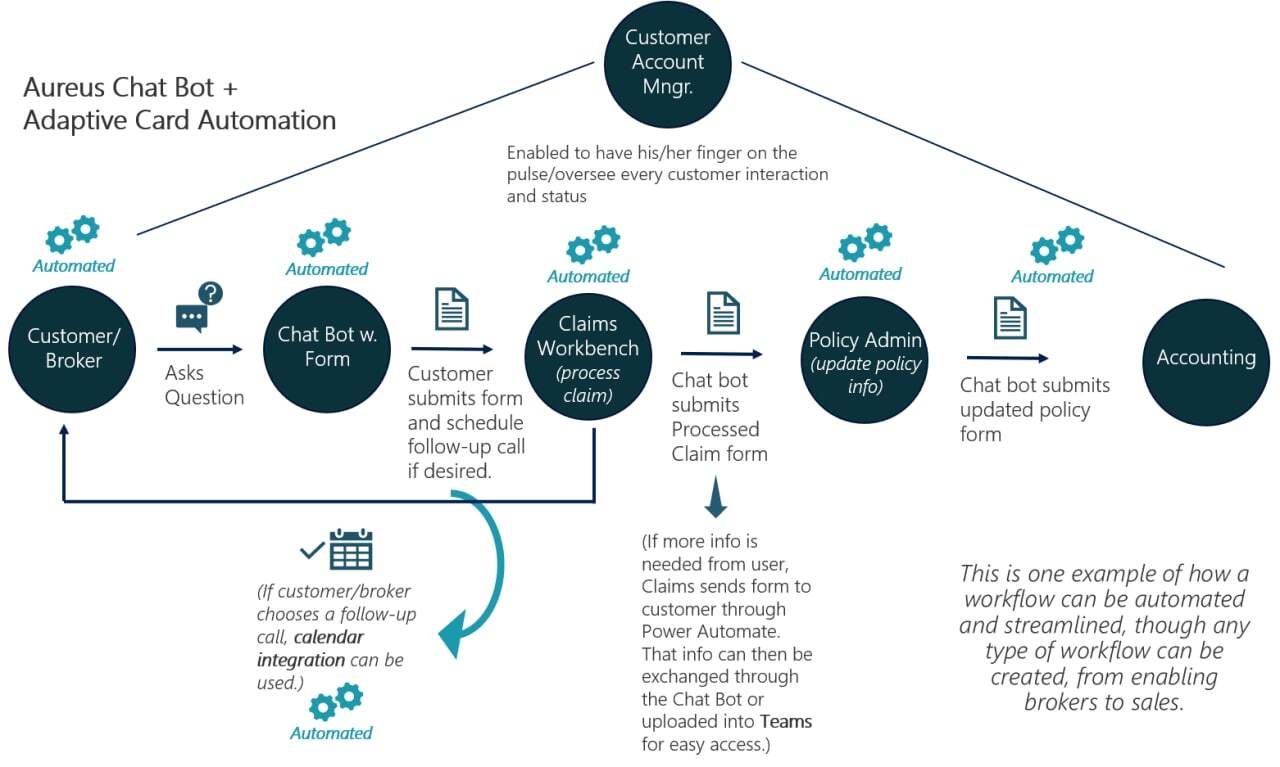

Streamlined Claim Workflow

Example: First Notice of Loss Flow

(Aureus Chat Bot + Adaptive Card Automation)

Streamlined Claim Workflow

Example: First Notice of Loss Flow

(Aureus Chat Bot + Adaptive Card Automation)

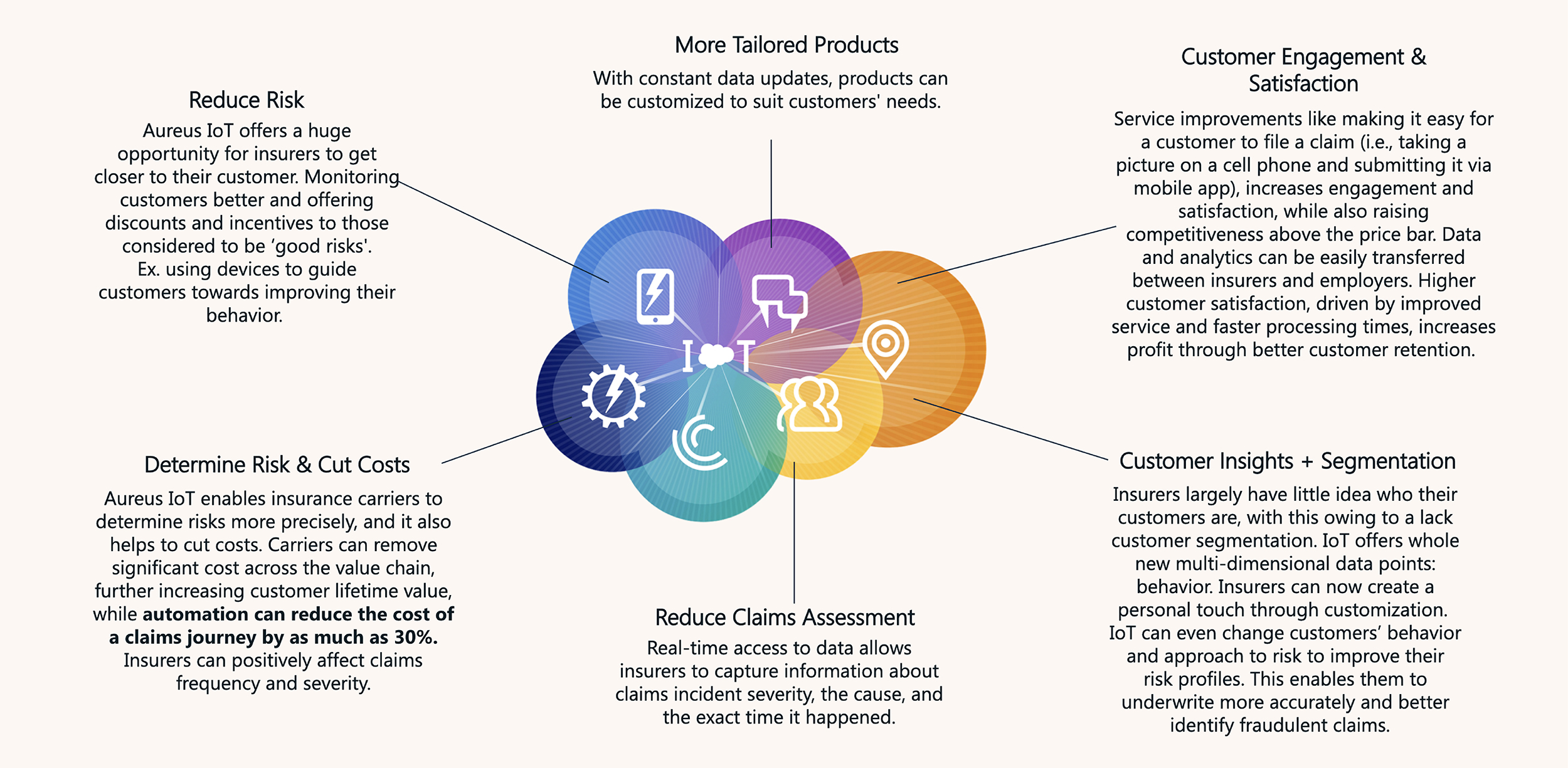

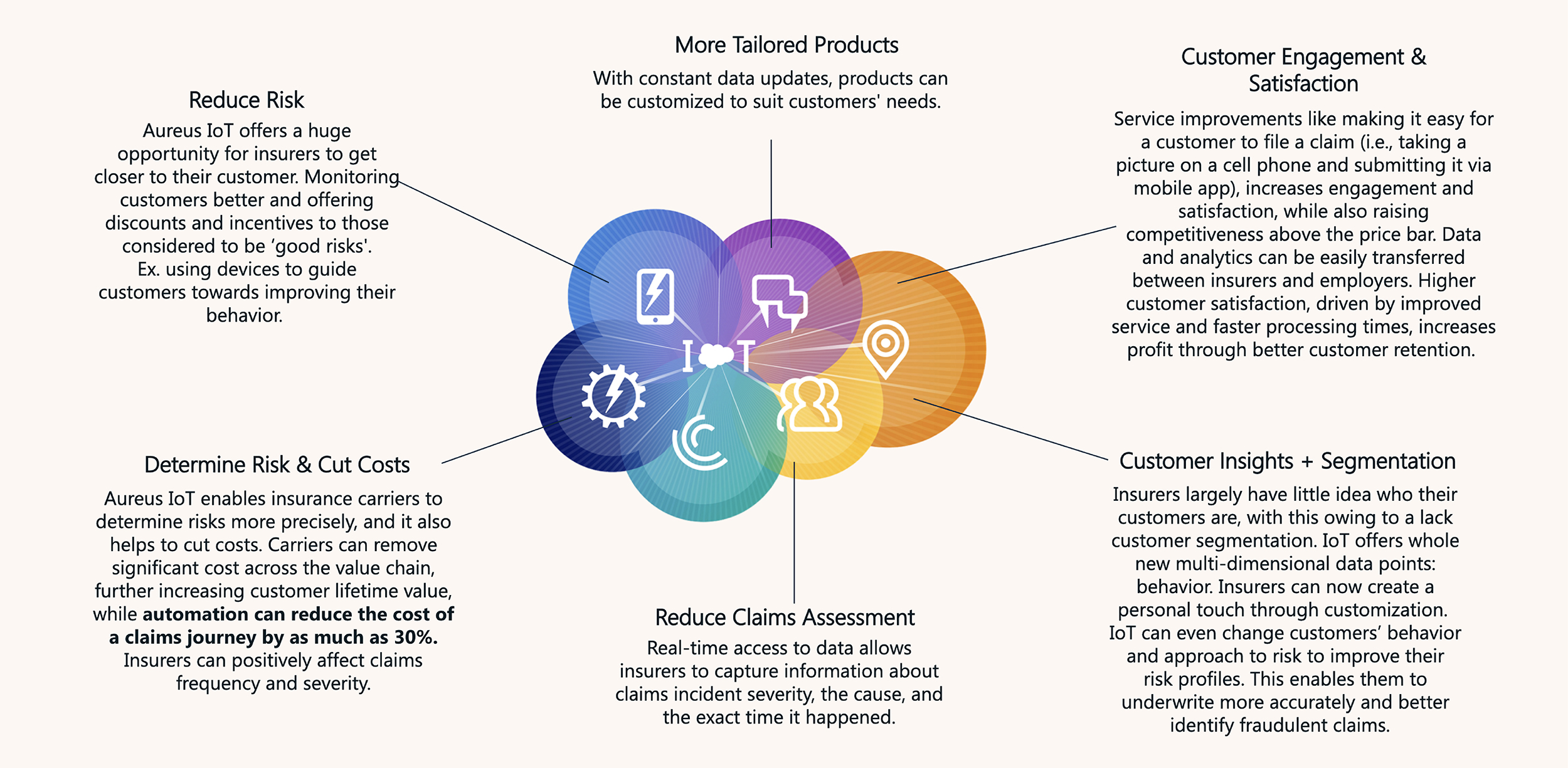

IoT Solutions for Risk Engineering

IoT Solutions for Risk Engineering